All Stories

TECOM Group PJSC has launched Phase 4 of the Innovation Hub in Dubai Internet City, committing AED 615 million to expand capacity for global technology companies seeking Grade-A office space in Dubai.

Sun Life, a global provider of high-net-worth insurance solutions, has received authorization from the Dubai Financial Services Authority (DFSA) to establish operations in the Dubai International Financial Centre (DIFC). The office is scheduled to begin operations in December under the leadership of Senior Executive Officer Sameera Anand.

The DIFC office will allow Sun Life to deepen its engagement with local and regional brokers and provide direct access to the company’s insurance expertise for high-net-worth (HNW) and ultra-high-net-worth (UHNW) clients across the Middle East.

“We are pleased to join DIFC, enhancing our ability to support partners and clients in the region,” said Sujoy Ghosh, CEO of Sun Life High Net Worth. “Our global expertise and financial strength position us to help clients protect and grow wealth across generations.”

His Excellency Arif Amiri, Chief Executive Officer of the DIFC Authority, welcomed Sun Life’s arrival, noting that the Centre’s regulatory clarity, tax framework, and infrastructure make it an attractive base for expanding regional operations.

Sun Life operates underwriting centers in Hong Kong, Singapore, and Bermuda, providing global insurance solutions and round-the-clock support for clients worldwide.

Photo credits: Government of Dubai Media Office

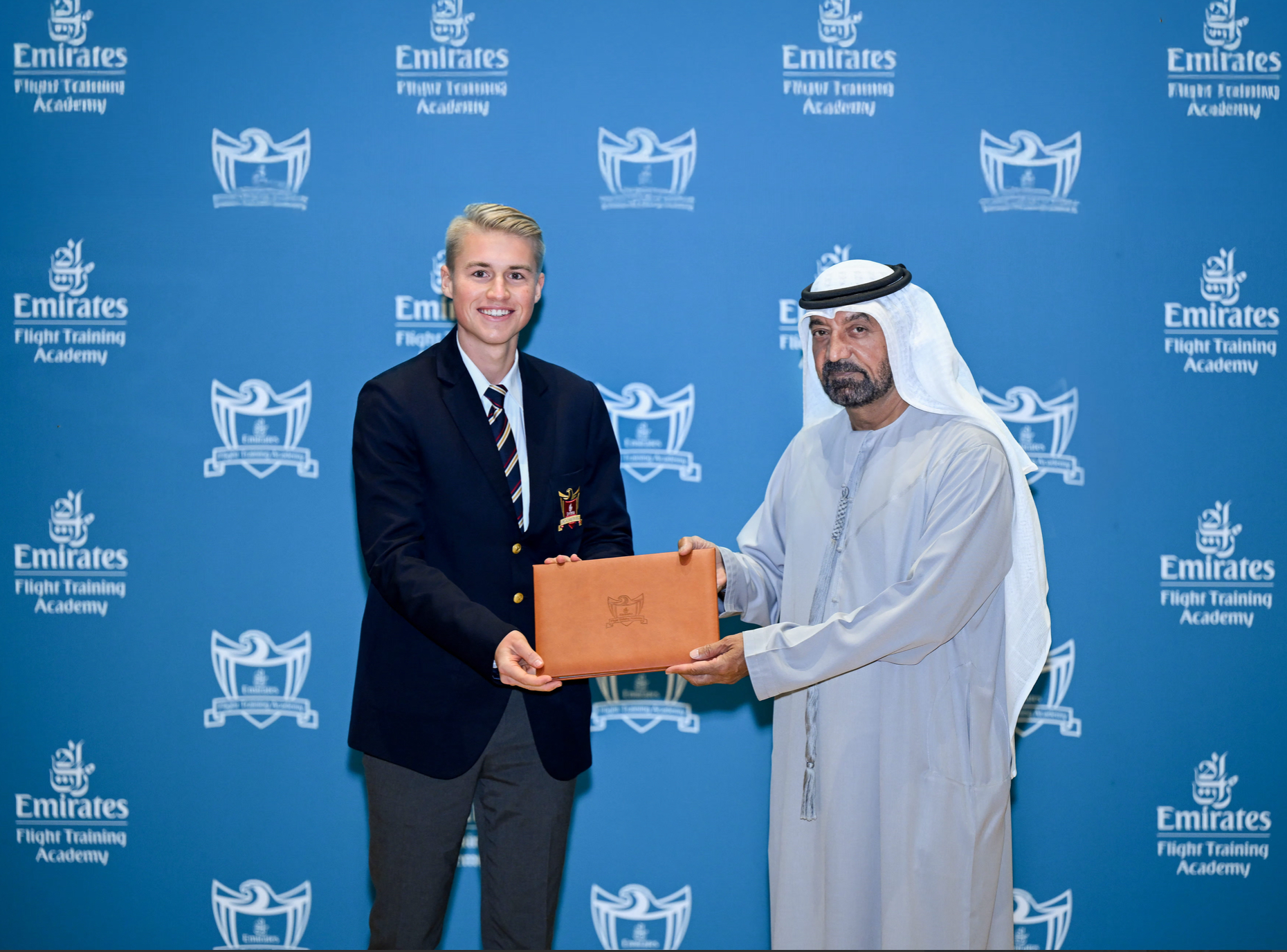

The Emirates Flight Training Academy marked its sixth graduation ceremony with 77 cadets completing the program, adding to a pipeline that has produced more than 300 trained pilots to date for Emirates and the wider aviation industry.

Of the graduating class, 52 cadets are part of the Emirates Group’s UAE National Pilot Cadet Programme, while 25 represent 15 other countries. Most EFTA graduates are now flying or continuing training with Emirates on the airline’s widebody fleet. The National Pilot Cadet Programme, the UAE’s largest initiative of its kind, is fully sponsored by the Group and provides a defined pathway to Emirates following graduation and type-rating completion.

The ceremony was attended by His Highness Sheikh Ahmed bin Saeed Al Maktoum, Chairman and Chief Executive of Emirates Airline & Group, along with senior leadership, faculty members, graduates, and their families.

Based in Dubai South, the academy integrates academic instruction, flight training technology and leadership development. Its campus includes residential facilities for cadets and a purpose-built training environment spanning the equivalent of 200 football fields. The facility features 36 classrooms, six full-motion simulators, an independent air traffic control tower and a dedicated 1,800-metre runway. Training is supported by a fleet of 32 aircraft, including Cirrus, Diamond, Gamebird and Embraer models.

During the ceremony, five cadets were recognised for outstanding performance, with an additional award presented for diligence.

Launched in 2017 at Dubai World Central, the Emirates Flight Training Academy was established to train UAE nationals and later expanded to include international students, supporting Emirates’ long-term pilot requirements.

Photo credits: Government of Dubai Media Office

Dubai Airports is entering the winter travel season with expanded schedules at Dubai International Airport (DXB) and Dubai World Central–Al Maktoum International Airport (DWC), reflecting strong seasonal demand and growing confidence from airline partners.

Direct traffic now accounts for 55 percent of passenger demand at DXB, in line with the annual winter upswing driven by cooler weather, major business and cultural events, and outbound travel by residents. Continued population growth in Dubai is also contributing to sustained point-to-point travel.

European and Central Asian routes are a key source of growth. FlyArystan joined the DXB network on Nov. 29 with twice-weekly flights from Aktau, Kazakhstan. Austrian Airlines resumed services from Vienna on Dec. 2 with five weekly flights. Capacity from Europe has also increased, with Virgin Atlantic deploying the A350-1000 on its Dubai route, lifting seat capacity by 52 percent, and British Airways restoring A380 services from London Heathrow.

Connectivity from South Asia and the Middle East has also expanded. Varesh Airline launched twice-weekly flights from Sari, Iran, on Oct. 30, while Fly Jinnah introduced twice-weekly services from Lahore on Nov. 2, reinforcing links with markets that typically see higher winter travel volumes.

Traffic from Saudi Arabia has recorded particularly strong growth. The country is DXB’s second-largest market, accounting for 7.8 percent of total passengers year to date through October. Combined traffic from Saudi Arabia across DXB and DWC reached 6.3 million passengers, up 1.3 percent year on year, with DWC reporting a 459 percent increase to 173,000 passengers.

DWC’s role within Dubai’s aviation system is becoming more prominent as airlines use its available capacity to complement DXB operations. The airport handled 1.1 million passengers in the first 10 months of the year, a 36.6 percent increase, supported by demand from CIS, GCC and Western European markets. Cargo volumes and aircraft movements also continued to rise.

Eurowings has contributed to this expansion with a new daily DXB service from Stuttgart, a three-times-weekly Düsseldorf service at DWC, and increased frequencies to Berlin, Cologne and Hannover, including Premium Bizclass on the Berlin route.

Dubai Airports said the winter schedule reflects resilient and diversified demand across both airports, balancing inbound tourism, resident travel and population growth as the city maintains its position as a leading global aviation hub.

Photo credits: Government of Dubai Media Office

Dubai International Financial Centre has become a member of the Global Cross-Border Privacy Rules (CBPR) Forum, positioning Dubai among a small group of jurisdictions shaping international standards for cross-border data protection.

The announcement was made at a Global CBPR Forum workshop in the Philippines. DIFC is the first jurisdiction outside the Asia-Pacific Economic Cooperation (APEC) framework to join the forum. As part of the membership requirements, DIFC has also joined the Global Cooperation Arrangement for Privacy Enforcement (Global CAPE), which supports collaboration among privacy regulators.

The move aligns with the UAE’s Digital Economy Strategy and reflects DIFC’s efforts to strengthen legal and regulatory frameworks governing the international flow of personal data. Membership in the forum is intended to facilitate global trade while maintaining safeguards for secure and transparent data transfers.

His Excellency Arif Amiri, Chief Executive Officer of DIFC Authority, said the membership recognises the centre’s work in data and privacy protection. He noted that the scale and speed of global data exchange, particularly in financial services, require clear and enforceable standards. DIFC’s data protection regime applies to more than 8,000 registered companies operating within the centre.

The CBPR system certifies organisations that meet specified requirements for cross-border transfers of personal data. Originally developed under APEC, the system was expanded in 2022 with the establishment of the Global CBPR Forum, which allows participation by jurisdictions beyond the Asia-Pacific region and aims to promote regulatory interoperability worldwide.

In 2023, DIFC introduced Regulation 10, addressing the processing of personal data through autonomous and semi-autonomous systems, including artificial intelligence and machine learning technologies. The regulation was the first of its kind in the Middle East, Africa and South Asia region and provides a framework for the responsible use of such technologies.

DIFC’s Global CBPR membership follows its participation in the Global Privacy Assembly (GPA) in Seoul in September. During that event, the DIFC Commissioner of Data Protection signed cooperation agreements with privacy authorities in Brazil, the Isle of Man, Uganda and Kenya. DIFC is scheduled to host the GPA conference in Dubai in 2026, following the #Risk GCC event held in December 2025.

Photo credits: Government of Dubai Media Office

Hatta Festival 2025 continues to highlight community-based activities aimed at preserving the UAE’s cultural and agricultural heritage, with a focus on engaging younger generations through direct participation.

As part of the festival’s community program, a cultural activity was held at a private farm in Hatta, where children and young people aged six to 16 were introduced to traditional Emirati farm life. The experience was hosted by Kaltham Al Hattawi, who guided participants through longstanding agricultural practices, including goat milking and the preparation of yogurt and cheese using traditional methods. Each step was explained to provide context on daily life in earlier generations.

Amina Taher, a member of the Hatta Festival Organising Committee, thanked Al Hattawi for hosting the activity and noted its educational value. She said the experience helped children and adolescents better understand agricultural traditions and community life in the UAE, highlighting Hatta’s role in preserving this heritage alongside its development as a tourism destination within Dubai.

The activity is part of the broader Hatta Festival 2025 program, currently taking place along the shores of Leem Lake. The festival continues to offer community-led experiences that emphasize cultural continuity and strengthen young people’s connection to national identity through practical, heritage-based learning.

Photo credits: Government of Dubai Media Office

Dubai’s Roads and Transport Authority has begun a pilot program using drones to clean traffic signals, replacing manlifts traditionally used for the task.

The authority said the initiative is intended to improve safety, cut costs, and reduce the environmental impact of maintenance operations. By eliminating the need for heavy equipment, the drone-based method lowers fuel and water use and reduces emissions.

According to Abdulla Ali Lootah, director of roads and facilities maintenance at the Traffic and Roads Agency, the pilot compares drone cleaning with conventional methods across several measures, including time, cost, quality, and safety compliance.

Initial trials were conducted at the Marrakech Street–Rebat Street junction, where limited traffic closures were put in place during testing. The authority reported that drones reduced cleaning time by between 25 and 50 percent, completing one side of a traffic signal in three to four minutes. Operational costs were reduced by up to 15 percent, with the potential to reach 25 percent as drone technology advances.

Mr. Lootah said the pilot would continue, with the next phase focused on refining cleaning methods while maintaining safety standards and avoiding disruption to traffic flow.

Photo credits: Government of Dubai Media Office

Dubai Electricity and Water Authority’s Sustainability and Innovation Centre has launched the CleanTech Alliance, an initiative aimed at giving local and international companies a platform to present their work in clean energy, sustainability and the energy transition. The program is intended to support progress toward net-zero goals in the UAE and internationally by connecting companies with investors and innovators active in the sector.

According to Saeed Mohammed Al Tayer, managing director and chief executive of DEWA, the centre plays a role in advancing the Dubai Clean Energy Strategy 2050 and the Dubai Net Zero Carbon Emissions Strategy 2050. He said the centre functions as a hub for clean and renewable energy innovation, supporting partnerships and technologies that contribute to Dubai’s sustainability objectives.

The Sustainability and Innovation Centre receives tens of thousands of visitors each year, including investors, start-ups, academic institutions and technology companies from around the world. Members of the CleanTech Alliance can participate in the centre’s initiatives, present their solutions on site and engage in programs designed to support innovation and collaboration in clean and renewable energy.

Photo credits: Government of Dubai Media Office

Nasdaq Dubai has listed a $500 million sukuk issued by MAF Sukuk Ltd. and guaranteed by Majid Al Futtaim Holding LLC, underscoring the company’s continued use of Dubai’s international debt markets. The Islamic bond matures on Oct. 22, 2035, carries a profit rate of 4.875 percent and is rated BBB by both S&P Global Ratings and Fitch Ratings.

The issuance drew orders exceeding $2 billion, according to the exchange, and will be used for general corporate purposes and refinancing. It follows Majid Al Futtaim’s recent hybrid bond sale, which was more than five and a half times oversubscribed and priced at 5.75 percent.

The listing was marked by a bell-ringing ceremony at Nasdaq Dubai attended by Ahmed Galal Ismail, chief executive of Majid Al Futtaim Holding, and Hamed Ali, chief executive of Nasdaq Dubai and the Dubai Financial Market. Both executives pointed to sustained investor demand and Dubai’s role as a hub for Islamic and conventional debt issuance.

With the latest sukuk, Majid Al Futtaim now has $2.2 billion of sukuk listed on Nasdaq Dubai across four issuances. The transaction brings the total value of debt securities listed on the exchange to more than $145 billion.

Photo credits: Government of Dubai Media Office

Emirates Airline and Dubai Humanitarian have launched an airbridge to Sri Lanka to transport urgent humanitarian assistance following the impact of Cyclone Ditwah. Over the next two weeks, Emirates will provide more than 100 tonnes of cargo capacity at no cost on its daily passenger flights to Colombo, enabling the rapid movement of relief supplies to affected areas.

The first consignments departed Dubai International Airport on Tuesday, 9 December, aboard three non-stop Emirates flights to Colombo. The shipments included fortified biscuits from the World Food Programme, food items and relief supplies from the Consulate General of Sri Lanka in Dubai and the Northern Emirates, and tarpaulins and additional materials from the International Federation of Red Cross and Red Crescent Societies. Upon arrival, the aid will be handed to a government-established disaster management unit for distribution to communities affected and displaced by severe flooding.

Sheikh Ahmed bin Saeed Al Maktoum, Chairman and Chief Executive of Emirates Airline and Group, said the airline was mobilising its operational capacity in coordination with Dubai Humanitarian to ensure a steady flow of essential supplies to Sri Lanka. He noted the airline’s commitment to dedicating bellyhold cargo space on its daily flights to support ongoing relief efforts.

Mohammed Ibrahim Al Shaibani, Chairman of Dubai Humanitarian, said the collaboration reflected the strength of the partnership between the two entities and Dubai’s role as a global center for humanitarian response. He added that close cooperation with partners was essential to delivering aid quickly and efficiently during emergencies.

Dubai Humanitarian, the world’s largest humanitarian hub, works with more than 80 humanitarian organisations and companies. Since formalising their partnership in 2020, Emirates and Dubai Humanitarian have coordinated multiple relief missions, transporting hundreds of tonnes of aid in response to natural disasters and humanitarian crises.

These efforts have included airlifts following the 2023 earthquakes in Turkey and Syria, as well as the establishment of an airbridge during catastrophic flooding in Pakistan, when Emirates provided cargo capacity across its passenger network to deliver emergency supplies to multiple airports across the country.

Photo credits: Government of Dubai Media Office

DP World has launched a new maritime service connecting Dubai’s Mina Rashid with Iraq’s Umm Qasr Port, cutting transit times to 36 hours and offering an alternative to overland trucking. The route is designed to carry up to 145 accompanied trailers per sailing, with drivers traveling on board.

The service was inaugurated at Mina Rashid with the arrival of DP World Express, a roll-on/roll-off vessel that has been upgraded at Drydocks World. Commercial operations are scheduled to begin in December 2025. The launch ceremony was attended by senior officials from the United Arab Emirates and Iraq, as well as executives from DP World and related authorities.

The vessel will transport non-containerised, full trailer units, providing a direct door-to-door option between the UAE and Iraq. DP World said the route is intended to improve reliability, reduce border-related delays and support onward connections to neighboring markets, including Jordan and Syria, through established inland networks. On return voyages, the ship will carry Iraqi export cargo to the UAE.

Company executives said the service responds to demand for faster and more predictable cross-border movement of goods, while reducing handling requirements. DP World also noted that shifting freight from longer land routes to sea transport could lower emissions associated with regional logistics.

Photo credits: Government of Dubai Media Office

Dubai International Financial Centre has entered the top tier of global hubs for hedge fund managers, passing a milestone that underscores its rapid rise in alternative investments.

The Centre has now registered more than 100 hedge funds, doubling from 50 at the start of 2024. Of these, 81 manage more than $1 billion in assets. DIFC’s growth places it among the world’s five largest hedge fund centres, reinforcing its role as the leading financial hub across the Middle East, Africa and South Asia.

New hedge fund managers establishing operations in DIFC during 2025 include Baron Capital Management, BlueCrest Capital, Naya Capital Management, Nine Masts Capital, North Rock Capital, Pearl Diver Capital, Select Equity Group, Strategic Investment Group, Silver Point Capital, Squarepoint Capital and Welwing Capital Group. They join established global firms already operating in the Centre, including Balyasny, BlackRock, Blue Owl, Brevan Howard, Dymon Asia, Exodus Point, Hudson Bay, Millennium, Qube Research and Technologies, and Verition.

DIFC has attracted hedge fund managers by offering access to Asian, European and U.S. markets, a large and specialised talent pool, and capital from ultra-high-net-worth individuals, family offices and sovereign wealth funds. Its banking and advisory infrastructure supports trading and capital-raising across regions.

Arif Amiri, Chief Executive Officer of the DIFC Authority, said the milestone reflected the maturity of the Centre’s platform and growing confidence among global managers. He noted that client focus, partnerships and product innovation have supported DIFC’s expansion across alternative investments.

One of DIFC’s initiatives is the DIFC Funds Centre, a co-working model designed to allow asset managers to establish and scale operations efficiently. The space hosts large global firms as well as mid-sized managers, spinouts and start-ups. More than 85 percent of DIFC-based hedge fund managers are able to raise and manage private and sovereign capital from the Centre.

Momentum in the sector is supported by broader trends outlined in DIFC’s recent report on alternative investments, which highlights the impact of technology, regulatory reform and wider investor access. According to the report, high-net-worth individuals and family offices have doubled their allocations to alternative investments since 2008, to about 15 percent of portfolios.

DIFC’s wider wealth and asset management sector now includes more than 470 firms. The Centre is home to over 1,250 family-related business entities and benefits from the UAE’s position as a leading destination for global wealth migration. Henley & Partners projects that 9,800 millionaires will have relocated to the UAE by the end of 2025.

Photo credits: Government of Dubai Media Office