All Stories

In the global economy of sport, attention often follows medals and scorelines. Less visible, but increasingly consequential, are the places where athletes prepare when no cameras are present. Over the past two decades, Dubai has emerged as one of those places - less a spectacle than an infrastructure of performance.

This is not an accident of branding. Dubai hosts established international competitions across tennis, golf, rugby and endurance sports, events sanctioned by global federations and embedded in official professional calendars. These tournaments did not arrive fully formed; they followed sustained investment in facilities, logistics and sports governance that meet international standards. Athletes come because the conditions allow them to work, not because the spotlight demands it.

Elite performance today is shaped as much by recovery and data as by raw talent. Dubai’s appeal lies in its integration of sports medicine, climate-controlled training environments and year-round access to facilities. These are not luxuries but necessities in an era when careers are longer, margins are thinner and injury prevention can define success. The city’s role mirrors a broader shift in global sport: preparation has become as decisive as competition.

For regional athletes, the implications are particularly significant. Access to world-class infrastructure at home reduces the historical need to relocate abroad for development. This matters not only for individual careers but for the sustainability of sporting ecosystems. National programs in the Gulf increasingly emphasize long-term athlete development, aligning with models used by established sporting nations.

Dubai’s influence does not rest on rewriting the rules of sport, but on respecting them. Its rise reflects a pragmatic understanding shared across elite athletics: performance follows systems, not slogans. As global sport continues to professionalize, cities that invest quietly and consistently in those systems will shape outcomes long before the podium.

Photo credits: Today’s Golfer. DP World Tour Championship

Under the patronage and directives of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the United Arab Emirates and Ruler of Dubai, the Private Office of His Highness the Ruler of Dubai organised desert cycling races for women and men on 31 January and 1 February as part of the Al Salam Cycling Championship.

The races were held at Al Marmoom Reserve in the Saih Al Salam area and formed part of the championship’s tenth season, held under the theme “Ten Years of Achievements and Success.” The Higher Organising Committee designed a technically demanding course requiring competitors to race on mountain bikes while wearing protective gear and carrying essential equipment, reflecting the challenges of desert terrain.

The combined prize pool for the two races totalled AED455,000, which organisers described as the largest prize offering for desert cycling races worldwide.

The women’s desert race covered a distance of 20 kilometres and included two categories: Emirati women and an open category for all nationalities. The men’s race followed the next day over 52 kilometres and featured two special challenges with dedicated cash prizes.

Omair bin Juma Al Falasi, Director General of the Private Office of His Highness the Ruler of Dubai and Chairman of the Higher Organising Committee, said the championship continues to prioritise inclusivity by offering competitions that engage a broad range of participants while aligning with developments in the sport. He noted that desert cycling presents distinct physical and technical demands compared to road racing.

The desert races marked the fourth and fifth events of the championship’s tenth season. Earlier events included the “Security and Safety” race for Emirati cyclists organised in cooperation with Dubai Police, the Ruler of Dubai Court Race held for the second consecutive year, and a women’s race at Al Marmoom Reserve featuring international competitors.

The championship also includes a photography contest organised in collaboration with the Hamdan Bin Mohammed Bin Rashid Al Maktoum International Photography Award, with winners to be announced at the conclusion of the season.

The Al Salam Cycling Championship is organised in cooperation with several strategic partners, including Dubai Police, Dubai Municipality, the Roads and Transport Authority, the Dubai Sports Council, the Government of Dubai Media Office, the UAE Cycling Federation, Dubai Sports Channel, and Dubai Film.

Photo credits: Government of Dubai Media Office

Dubai has built one of the world’s most concentrated and diversified retail landscapes, positioning shopping not as a side attraction but as a central pillar of its economy and global brand.

Retail contributes a significant share to Dubai’s non-oil GDP, supported by a combination of large-scale malls, traditional markets, and a steady flow of international visitors. The city is home to more than 60 shopping malls, including The Dubai Mall - one of the largest malls globally by total area - as well as Mall of the Emirates, which introduced indoor skiing to the retail experience in the Middle East. These complexes function as mixed-use destinations, combining shopping with dining, entertainment, and tourism infrastructure.

Dubai’s appeal as a shopping hub is reinforced by its role as a global trade and logistics center. Its ports, free zones, and air connectivity have enabled international brands to establish regional headquarters and flagship stores in the city. Luxury labels, mass-market retailers, and emerging designers operate side by side, reflecting Dubai’s position at the intersection of Europe, Asia, and Africa.

Alongside modern retail, traditional souks remain active parts of the commercial fabric. The Gold Souk, Textile Souk, and Spice Souk in historic areas such as Deira continue to serve residents and visitors, offering goods that reflect long-standing trading practices. These markets coexist with newer developments, underscoring Dubai’s approach of layering growth onto existing commercial traditions rather than replacing them entirely.

Seasonal retail events have further shaped consumer culture. The Dubai Shopping Festival, launched in 1996, remains one of the city’s most prominent annual events, drawing international visitors with promotions across retail, hospitality, and entertainment sectors. Such initiatives align with broader tourism strategies aimed at sustaining year-round visitor traffic.

Dubai’s retail sector has also adapted quickly to changing consumer behavior. E-commerce adoption has accelerated, while physical stores increasingly emphasize experience, convenience, and integration with digital platforms. Government-led initiatives supporting smart services and cashless payments have reinforced this shift.

Taken together, Dubai’s shopping ecosystem reflects the city’s broader economic strategy: diversification, scale, and connectivity. Retail in Dubai is not simply about consumption, but about positioning the city as a global marketplace - one that continues to evolve with consumer trends while remaining rooted in its trading history.

Photo credits: Wikipedia. Dubai Mall

DMCC, in partnership with Dubai real estate developer Sweid & Sweid, has announced the launch of BAY360, a new mixed-use lifestyle destination in Jumeirah Lakes Towers (JLT).

Planned as a neighbourhood and community hub, BAY360 will introduce a range of essential retail, dining, wellness and recreational amenities intended to support everyday life in the district. The project forms part of DMCC’s broader programme to upgrade shared spaces across JLT, with a focus on improving accessibility, connectivity and overall liveability.

The development will be built on a portion of Lake D, with most of the lake retained as a central feature. The design prioritises integration with the surrounding waterfront, enhancing pedestrian movement and activating public areas while maintaining the open, lakeside character of the site.

BAY360 will be anchored by a 22,000-square-foot Spinneys supermarket. Additional components include cafés and restaurants, some with lake-facing outdoor terraces, as well as medical facilities, lifestyle retail, rooftop padel courts and family-oriented outdoor spaces. The project will also include an underground car park with approximately 300 spaces.

Beyond the site itself, DMCC and Sweid & Sweid will implement improvements around Lake D to enhance connectivity across JLT. These include a redesigned pedestrian route linking the metro station to the opposite side of the lake and improved access to JLT Park. Planned upgrades to the lake edges will add greenery, seating and walkways.

Ahmed Bin Sulayem, Executive Chairman and Chief Executive Officer of DMCC, said the project reflects DMCC’s long-term strategy to strengthen the quality and functionality of JLT’s public realm. Maher Sweid, Managing Partner of Sweid & Sweid, said BAY360 represents the company’s third project in the district and builds on its ongoing investment in JLT, with completion targeted for the end of 2027.

Photo credits: Government of Dubai Media Office

Hussain Sajwani is an Emirati billionaire entrepreneur best known as the founder and chairman of DAMAC Properties, one of Dubai’s most prominent luxury real estate developers. He has played a significant role in shaping Dubai’s property market and expanding its global footprint.

Early Life and Career Beginnings

Sajwani was born in the early 1950s in the United Arab Emirates and is a UAE national. He earned a bachelor’s degree in economics from the University of Washington in Seattle. After graduating, he returned to the Gulf and started his own businesses, initially in food services. His catering company grew to serve major clients, including the U.S. military and large construction firms.

Founding DAMAC Properties

In 2002, after Dubai opened up its property market to foreign ownership, Sajwani established DAMAC Properties. The company focused on luxury residential and commercial real estate, capitalizing on Dubai’s rapid growth as a business and tourism hub. In its first project, units were reportedly sold in less than six months - a sign of the strong demand for high‑end properties at the time.

Under his leadership, DAMAC has developed tens of thousands of homes and commercial units and created large mixed‑use communities. The firm also forged high‑profile collaborations with global luxury brands such as Versace, Cavalli, and Bugatti for branded residences, enhancing Dubai’s reputation as a centre for luxury living.

Dubai and Global Expansion

Although DAMAC is based in Dubai, its projects extend beyond the UAE. The group has had developments in Saudi Arabia, the United Kingdom, the United States, and other international cities. It also expanded into related sectors such as hotel management, operating properties under partnerships with brands like Radisson and Paramount Hotels.

In the 2010s, DAMAC briefly listed publicly - first on the London Stock Exchange and later on the Dubai Financial Market - before Sajwani took the company private again in 2022 by acquiring the remaining shares.

Net Worth and Recognition

As of early 2026, Sajwani’s net worth was estimated at around $10.2 billion, placing him among the world’s wealthiest individuals and one of the richest Arabs, according to Forbes’ billionaire rankings.

Philanthropy and Broader Interests

Beyond real estate, Sajwani and his group have diversified interests. These include investments in data centres, luxury fashion and jewellery brands (such as Roberto Cavalli and de GRISOGONO), and private equity markets.

He is also involved in philanthropic initiatives through the Hussain Sajwani - DAMAC Foundation, which supports education and technology learning programs in the Arab world.

Legacy in Dubai

Sajwani’s business journey mirrors much of Dubai’s transformation over the past two decades, from a regional trading port to a global city known for luxury real estate, tourism, and investment. His work with DAMAC has left a visible imprint on the skyline and helped bolster Dubai’s appeal to international investors.

Photo credits: Forbes. Hussain Sajwani

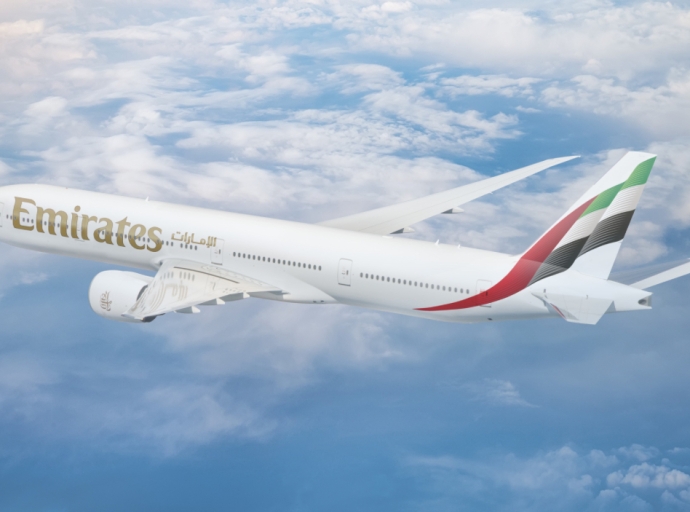

Emirates will expand its operations to Manila with four additional weekly flights starting April 2, as part of its Southeast Asia growth strategy. The flights, EK330/331, will operate on Mondays, Wednesdays, Thursdays, and Saturdays. EK330 departs Dubai at 12:45 p.m., arriving in Manila at 1:25 a.m. the next day, while EK331 returns from Manila at 3:25 a.m., landing in Dubai at 8:25 a.m. All flights will use Boeing 777-300ER aircraft.

The aircraft feature eight First Class suites, 42 lie-flat Business Class seats, and 304 Economy Class seats. The expansion increases connectivity for corporate travelers, maritime clients, and the Filipino diaspora across Emirates’ global network, including destinations in Europe, the United States, the Middle East, and South Africa. The additional flights also improve connections to North America and late-morning European departures via Dubai.

Each 777-300ER offers up to 20 tonnes of cargo capacity, enhancing trade between Dubai, Manila, and Emirates’ wider network. The expansion comes amid growing economic ties between the UAE and the Philippines, supported by the recently signed Comprehensive Economic Partnership Agreement.

Emirates began flights to Manila in 1990 and now operates 28 weekly services, including circular routes to Cebu and Clark, which will increase to 34 weekly flights with the new services. Through a partnership with Philippine Airlines, Emirates provides connections to multiple domestic points with baggage check-through to final destinations.

Photo credits: Government of Dubai Media Office

Dubai Chamber of Commerce has launched the Holiday Homes Business Group to support the growth and development of the emirate’s holiday homes sector. The group brings together companies specializing in holiday home management and aims to provide a unified voice to advocate for the sector’s interests.

The group will serve as a platform for dialogue between government authorities and private companies, addressing the sector’s current landscape, challenges, and opportunities. It will also provide recommendations to strengthen regulatory policies, promote professional standards, and support the long-term, sustainable growth of Dubai’s holiday homes market.

Dubai’s holiday homes sector has expanded significantly, with 2,928 companies now registered as members of Dubai Chamber of Commerce. This growth reflects the broader performance of Dubai’s tourism industry, which has driven increased demand for short-term rental accommodations.

Maha Al Gargawi, Vice President of Business Advocacy at Dubai Chambers, said the initiative reinforces the role of business groups in linking the private sector with decision-makers, shaping policy, promoting best practices, and supporting innovation across sectors.

The Holiday Homes Business Group underscores Dubai’s focus on strengthening its tourism infrastructure and maintaining its position as a leading global destination.

Photo credits: Government of Dubai Media Office

Dubai’s Roads and Transport Authority (RTA), in collaboration with Dubai Aviation Engineering Projects (DAEP), has completed an expansion of the bridge leading to Terminal 1 at Dubai International Airport. The upgrade increased the number of lanes from three to four, boosting the bridge’s capacity from 4,200 to 5,600 vehicles per hour, a 33 percent rise.

The expansion is intended to improve traffic flow, reduce travel times, and enhance the overall experience for airport users. It is part of RTA’s broader strategy to strengthen the efficiency of Dubai’s road network and ensure seamless connectivity between major corridors and critical facilities.

The new bridge features steel box girders with a composite concrete deck, a design chosen for structural efficiency and rapid construction without disrupting traffic on Airport Street or requiring temporary supports beneath the bridge. The project also included road pavement upgrades, improvements to utilities and supporting infrastructure, new street lighting, and landscaping to integrate the bridge with the surrounding road network.

RTA and DAEP emphasized that the project aligns with the operational needs of Dubai International Airport, the world’s busiest airport for international passengers, and supports the sustainable growth of air traffic. The authorities reaffirmed their commitment to ongoing infrastructure development, efficient traffic management, and enhancing Dubai’s position as a leading hub for aviation and international travel.

Photo credits: Government of Dubai Media Office

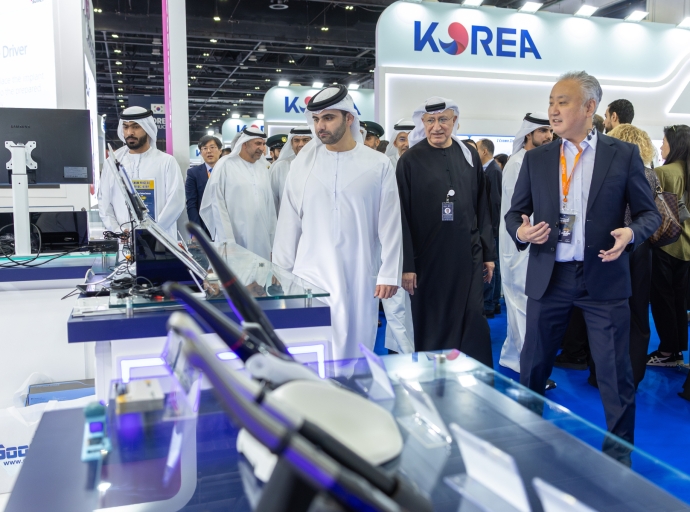

His Highness Sheikh Mansoor bin Mohammed bin Rashid Al Maktoum, Vice Chairman of the Dubai Health Board of Directors, opened the 30th UAE International Dental Conference and Arab Dental Exhibition (AEEDC Dubai 2026) at the Dubai World Trade Centre. The three-day event, running through January 21, attracts over 74,000 participants from 155 countries.

AEEDC Dubai, now recognized as the world’s largest annual scientific conference and exhibition for dentistry and oral health, brings together experts, academic institutions, and companies to exchange knowledge and showcase advances in dental technologies and practices. The exhibition features more than 5,860 brands represented by 4,319 companies, including international pavilions from Germany, Brazil, Switzerland, Spain, Turkey, Italy, and Korea.

The conference includes 183 scientific sessions, 20 hands-on workshops, and 390 poster presentations, with over 192 international speakers covering fields such as digital dentistry, prosthodontics, pediatric dentistry, laser and robotic dentistry, oral implantology, and forensic odontology. Egypt participates as Guest of Honour, reflecting ongoing strategic and healthcare cooperation with the UAE.

Organized by INDEX Conferences and Exhibitions with support from the Dubai Health Authority, AEEDC Dubai continues to strengthen the emirate’s position as a global hub for medical knowledge, innovation, and professional development in dentistry.

Photo credits: Government of Dubai Media Office

Emirates has confirmed a six-year partnership with the Hero Dubai Desert Classic, reinforcing the airline’s ongoing support for golf in Dubai.

The Hero Dubai Desert Classic, the region’s longest-running golf tournament, opens the DP World Tour’s Rolex Series. Since its 1989 debut at the Majlis Course at Emirates Golf Club, the event has drawn top international players and global attention, establishing Dubai as a premier golf destination.

Under the partnership, Emirates will receive branding across the tournament grounds, including course signage, scoreboards, buggies, spectator areas, and digital platforms. The airline will also provide premium hospitality, Pro-Am participation, and exclusive experiences for its guests.

Sir Tim Clark, Emirates Airline President, noted the tournament’s role in showcasing Dubai’s golf courses worldwide and attracting leading players, while Simon Corkill, Executive Tournament Director, highlighted the collaboration as part of the event’s growth and international appeal.

The 2026 Hero Dubai Desert Classic takes place January 22–25, featuring top players including four-time champion Rory McIlroy, competing for a total prize of $9 million. Emirates has been a key partner in Dubai’s golf scene for nearly four decades and supports 21 tournaments across 26 countries through its association with the DP World Tour.

Photo credits: Government of Dubai Media Office

His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, visited the fifth edition of World of Coffee Dubai at the Dubai World Trade Centre (DWTC) on January 18, 2026. The exhibition runs through January 20.

Sheikh Mohammed was accompanied by His Highness Sheikh Ahmed bin Mohammed bin Rashid Al Maktoum, Second Deputy Ruler of Dubai, and His Highness Sheikh Mansoor bin Mohammed bin Rashid Al Maktoum, President of the UAE National Olympic Committee. During the visit, they toured several pavilions showcasing exhibits from across the coffee industry.

Helal Saeed Almarri, Director General of the Dubai World Trade Centre Authority, briefed the visitors on the exhibition’s scale and international reach. Organised by DXB LIVE in collaboration with the Specialty Coffee Association, World of Coffee Dubai 2026 features over 2,100 companies from 78 countries, marking its largest and most internationally diverse edition to date.

The exhibition covers the full coffee value chain, from cultivation and production to processing, roasting, and brewing equipment. According to Statista, the global coffee sector’s projected revenue in 2026 is approximately $495.7 billion. The 2026 edition occupies more than 20,000 square metres and includes live auctions, international championships, workshops, and educational programs, providing trade and networking opportunities for industry professionals.

Khalid Al Hammadi, Senior Vice President of DXB LIVE, highlighted the growth of World of Coffee Dubai from a regional platform to a globally recognized hub connecting producers, manufacturers, and buyers.

Photo credits: Government of Dubai Media Office

Dubai has increased its network of electric vehicle (EV) charging points to more than 1,860, according to HE Saeed Mohammed Al Tayer, managing director and CEO of the Dubai Electricity and Water Authority (DEWA). The expansion includes stations licensed by DEWA in partnership with government and private sector entities.

As of mid-January 2026, the EV Green Charger initiative had registered 23,600 users and supplied over 55,200 megawatt hours of electricity since its 2014 launch. DEWA estimates this amount of electricity could power more than 276 million kilometres of EV travel.

Al Tayer emphasized that the expansion supports Dubai’s broader sustainability goals, including the UAE Net Zero 2050 Strategy and the Dubai Green Mobility Strategy 2030. The initiative aligns with efforts to improve air quality, reduce greenhouse gas emissions, and position Dubai as a global leader in green mobility.

DEWA offers four types of charging stations - ultra-fast, fast, public, and wall-box - accessible through its website, mobile app, and 14 additional digital platforms. Customers can create a Green Charger account or use the service through the ‘Guest Mode’ feature, allowing access to stations within an hour of vehicle registration.

Photo credits: Government of Dubai Media Office